Learn More About US

Established in 2007 in Sydney, Halcyon Wealth Advisers derives its name from the term 'halcyon’, meaning 'marked by peace and prosperity.' This name captures our mission of crafting financial plans that secure our client’s financial prosperity well into the future. Over the course of two decades, Halcyon Wealth has evolved into a highly esteemed holistic financial advisory business, offering a suite of wealth creation, wealth management, and wealth protection services.

Halcyon has recently expanded its operations by acquiring several Sydney-based businesses. This strategic growth has allowed us to build a sizable team, fostering an environment favourable to providing an outstanding client experience, regardless of life stage or financial circumstances.

Our Investment Philosophy

To meet your financial objectives

by taking the least amount of risk to obtain the return you need.

Diversify, buy at a good price and hold, and stay the course.

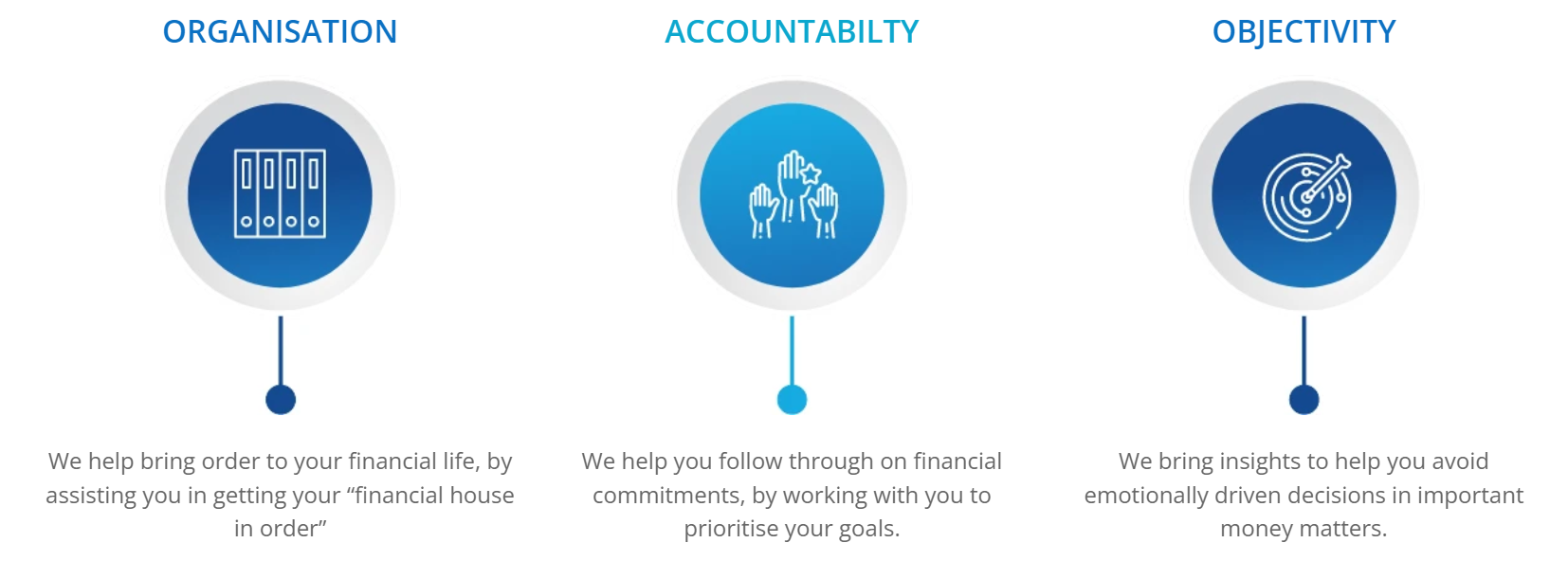

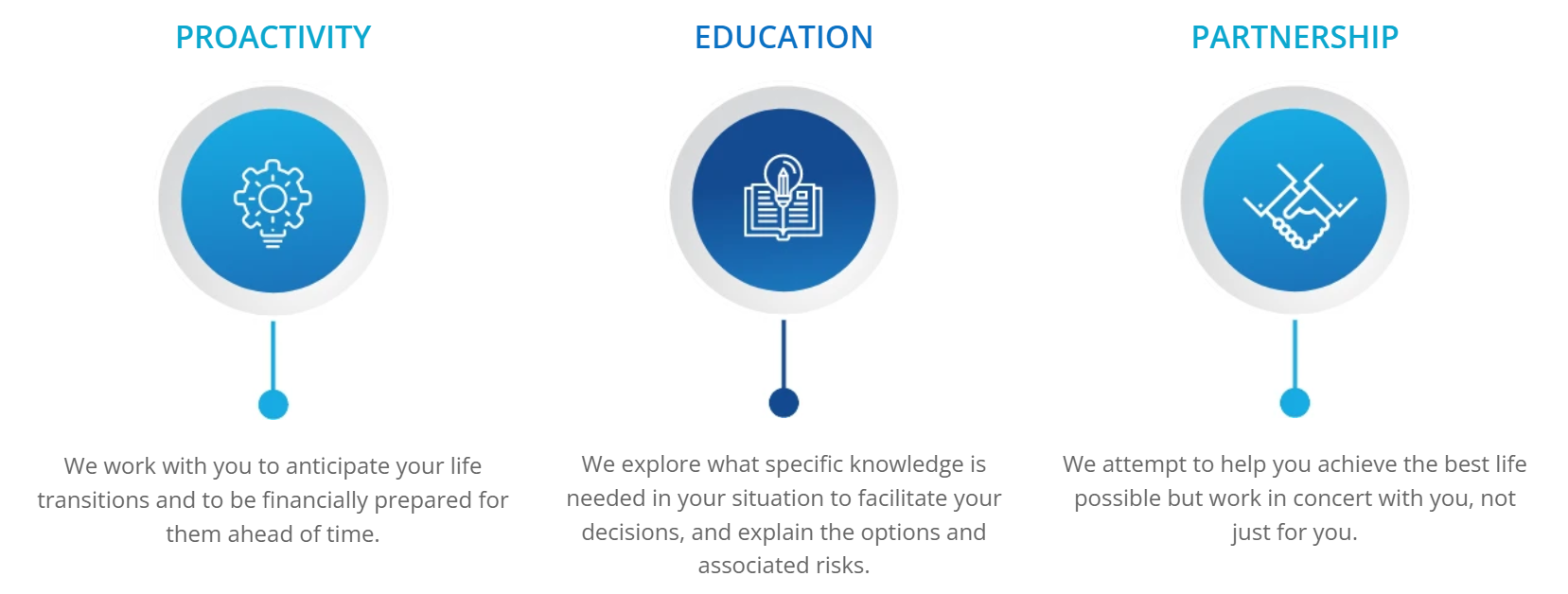

How We Can Help You

The MonSTaR Foundation

MonSTaR raises funds for motor neuron disease and supports educational programmes for children with disabilities and special learning needs.

Halcyon Wealth Advisers have chosen to support The MonSTaR Foundation due to the close ties with our Senior Adviser, Hamish Pearce. Hamish lost his wife, Fiona, to Motor Neurone Disease (MND) when she was just 33 years of age.

The MonSTaR Foundation was formed in 2007 when Hamish and a couple of his mates (who had sisters with disabilities) were inspired to start a charity to raise funds for MND and The STaR Association. The STaR Association places special needs teachers in mainstream daycare centres so that kids with all kinds of intellectual and physical disabilities can assimilate with other kids and learn together.

To date, The MonSTaR Foundation has raised over $4.5m for motor neuron disease and supported education programs for children with disabilities and special learning needs.

You can read more about this great charity by clicking here.

Our Licensee

Madison Financial Group is an Australian Financial Services Licensee providing licensee services and support to our business.

Madison was founded in 1983 by financial advisers with the aim of creating a community of professional advice businesses underpinned by entrepreneurial and innovative thinking. Their purpose is to lead and foster a community of professional, qualified business owners/advisers who provide quality advice with great care to their clients. As a result, their licensee proposition embeds a culture of self-governance and commercial business growth.

Madison is licensed under the Corporations Act 2001 (Cth) to provide financial product advice, and to deal, in relation to the following financial products:

- Basic deposit products

- Non-basic deposit products

- Securities

- Government debentures, stocks and bonds

- Life insurance investment products

- Life insurance risk products

- Managed investments

- Managed discretionary account services

- Retirement savings account products

- Standard margin lending facility

- Superannuation

Together with us, Madison is responsible for the services and advice we provide to you in our capacity as your Financial Adviser, under our authorisation as an Authorised Representative of Madison.

Madison is a wholly owned subsidiary of Infocus Wealth Management Ltd ABN 28 103 551 015.

Financial Services Guide

The Financial Services Guide (FSG) is an important document that outlines the types of products and services the advisers of Halcyon Wealth Advisers Pty Ltd are authorised to provide under our licensee, Madison Financial Group (Australian Financial Services Licence No.246679).

The purpose of the FSG is to provide you with information, prior to a financial service being provided, about:

- Who the adviser is providing the service;

- What services the adviser is authorised to provide under the Madison AFS licence;

- Details of who the adviser acts for in providing the service;

- How we and our associates are paid;

- Any potential conflict of interest we may have and

- Our internal and external dispute resolution procedures and how you can assess them.

Please click on the link below to view our FSG in PDF format.

To find out more about our financial capabilities, contact us on (02) 8920 8933.